Earthship & Off Grid Financing

Looking to move off grid or become part of the Earthship community? We have financing options available to help realize your sustainable dreams.

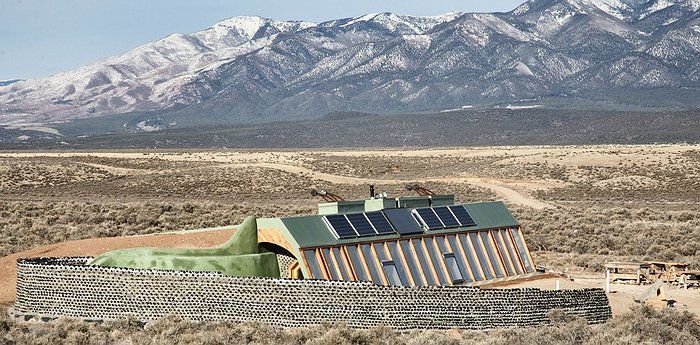

Green homes and alternative lifestyles take center stage for many people who live in Northern New Mexico. The sunlight offers outstanding opportunity to invest in solar panels. The spring winds allow for wind energy sources, such as wind turbines.

We know that many people are unsure or unaware of financing opportunities for these off-grid/alternative structures. We at Dimond Mortgage have had success financing such properties given the amount of these types of homes sold and on the market in our area. We are able to finance homes that utilize solar panels, water cisterns and are partially bermed (Earthships, for example).

There are no hard and fast rules or guidelines that deter financing for these special properties. The main provision is that there are comparable properties to support the market value. In other words, the appraised value would have to be supported by “like” properties utilizing the same alternative heat and electric source with similar square footage and located within a certain parameter of the subject property.

Most off-grid homes are reasonably priced for the consumer, and there is the added benefit of not having to pay utility bills. Owning a property where one’s environmental impact is lessened also provides peace of mind. Dimond Mortgage is prepared to work through the financing of these types of properties to promote sustainable living in our community.

The Federal Housing Administration and U.S. Department of Veterans Affairs also offer cost-effective and energy-efficient mortgages for home purchases, refinances, new construction and rehab loans. “Cost effective refers to the costs of the energy efficiency improvements that are less than the present value of the energy saved over the estimated useful life of those improvements.”

These specific energy-efficient mortgage loans require an “energy package” that is agreed upon by a qualified home energy rater and the borrower. The home energy rater must be a qualified, certified assessor who meets local or state requirements for conducting residential energy assessments. The energy package is based on the recommendations and analysis of the home rater. The energy improvements can include energy-saving equipment, solar and wind technologies. The energy package can include materials, labor, inspections and the assessment report created by the home energy rater. The energy package could also include the cost of the general contractor. The borrower can finance up to 100 percent of the energy package provided that the “present value of the energy saved over the useful life of the improvements is demonstrated.” The lender wants to be assured that the improvements result in bona fide savings for the borrower.

Please call us with any questions pertaining to the financing of alternative properties. Any of our qualified loan officers would be happy to speak with you about these options or any other mortgage needs you may have.

Happy Summer!